Nothing is more maddening for clinicians and patients alike than cutting through the tangled thickets of dental insurance. AI seems primed to help—but will reducing humans’ role in adjudicating coverage approval or denial be a good thing?

By Jerry Markon

AT A TECHNOLOGY HUB in Amsterdam, a group of engineers are working to use artificial intelligence to solve one of dentistry’s most vexing problems: determining a given patient’s insurance benefits.

Currently, practices spend countless hours on the phone with insurance companies seeking an explanation of benefits (EOB), which breaks down what the insurer will pay for each procedure. The process is heavily manual—and, as such, often frustratingly slow.

Now, the engineers at Teero, a Minnesota-based dental staffing firm, are designing a product intended to automate the entire EOB experience. It would use AI to retrieve information from insurer websites, make those endless phone calls—and even speak to insurers through AI-powered “voice agents.”

“EOBs are one of the biggest things practice managers spend time on now, and this will retrieve them automatically,” says Teero cofounder and CEO Nate Anderson, who frequently flies to Amsterdam to consult with about 10 engineers working in the company’s office there, known as the tech hub.

“This is where AI will totally change the game on dental insurance,” says Anderson, 35, whose firm has produced a prototype for one dental office and hopes to launch the product next year.

I think the race is on to put A.I. in all dental insurance products. We are in the early innings of a new industry forming.”

—Nate Anderson

Cofounder and CEO, Teero

Teero’s efforts symbolize the current state of AI in dental insurance: It is emerging, with innovative solutions in the pipeline and, by all accounts, has significant potential to help streamline the cumbersome insurance system. But it’s not fully there yet.

Even as AI’s clinical uses throughout dentistry are growing rapidly (see page 18), its adoption in the insurance sphere has been rather more uneven, insurers and dentists say. Though precise numbers are hard to come by, many insurance companies have begun evaluating the use of AI for things such as helping review claims, detecting fraud and aiding clinicians in evaluating X-rays.

But AI’s adoption is by no means universal, industry officials say, with some insurers remaining cautious about a technology that lacks the empathy of a human claims reviewer and can raise concerns about data privacy and security.

“I think people are still figuring it out,” says Mike Adelberg, 57 (right), executive director of the National Association of Dental Plans, the primary trade association for dental insurers. “I would be surprised if AI is dominating the operations of many insurance plans at this point. I do think there is a lot of interest and a lot of experimenting and pilot projects going on.”

“I think people are still figuring it out,” says Mike Adelberg, 57 (right), executive director of the National Association of Dental Plans, the primary trade association for dental insurers. “I would be surprised if AI is dominating the operations of many insurance plans at this point. I do think there is a lot of interest and a lot of experimenting and pilot projects going on.”

Dr. Roosevelt Allen (left), chief dental officer at United Concordia Dental, says the insurer is “continuing to evaluate the use of AI in our claims adjudication process.” Industrywide, he adds, “I expect that we will continue to see greater focus on AI as dental insurance companies determine what AI’s value proposition is, as data becomes more refined and as AI algorithms improve.”

Dr. Roosevelt Allen (left), chief dental officer at United Concordia Dental, says the insurer is “continuing to evaluate the use of AI in our claims adjudication process.” Industrywide, he adds, “I expect that we will continue to see greater focus on AI as dental insurance companies determine what AI’s value proposition is, as data becomes more refined and as AI algorithms improve.”

Yet newer entrants to the field believe AI’s value in rapidly sifting through and analyzing masses of insurance data is already established—and that the AI revolution in dental insurance is well underway.

“I think the race is on to put AI in all dental insurance products,” says Teero’s Anderson, whose firm mainly operates a staffing app for hygienists but is branching out into insurance. “We are in the early innings of a new industry forming.”

Innovators in the field are finding a willing audience among some dentists. In Scotch Plains, New Jersey, Dr. Kashfia Vohra, co-owner of Kind Dental, had grown tired of the complexities—and annoyances—of the dental insurance process. “I’ve just seen too many patients and doctors get frustrated because an insurance company gave out wrong information, a procedure costs more and a patient doesn’t want to pay,” she says. “The stories are endless.”

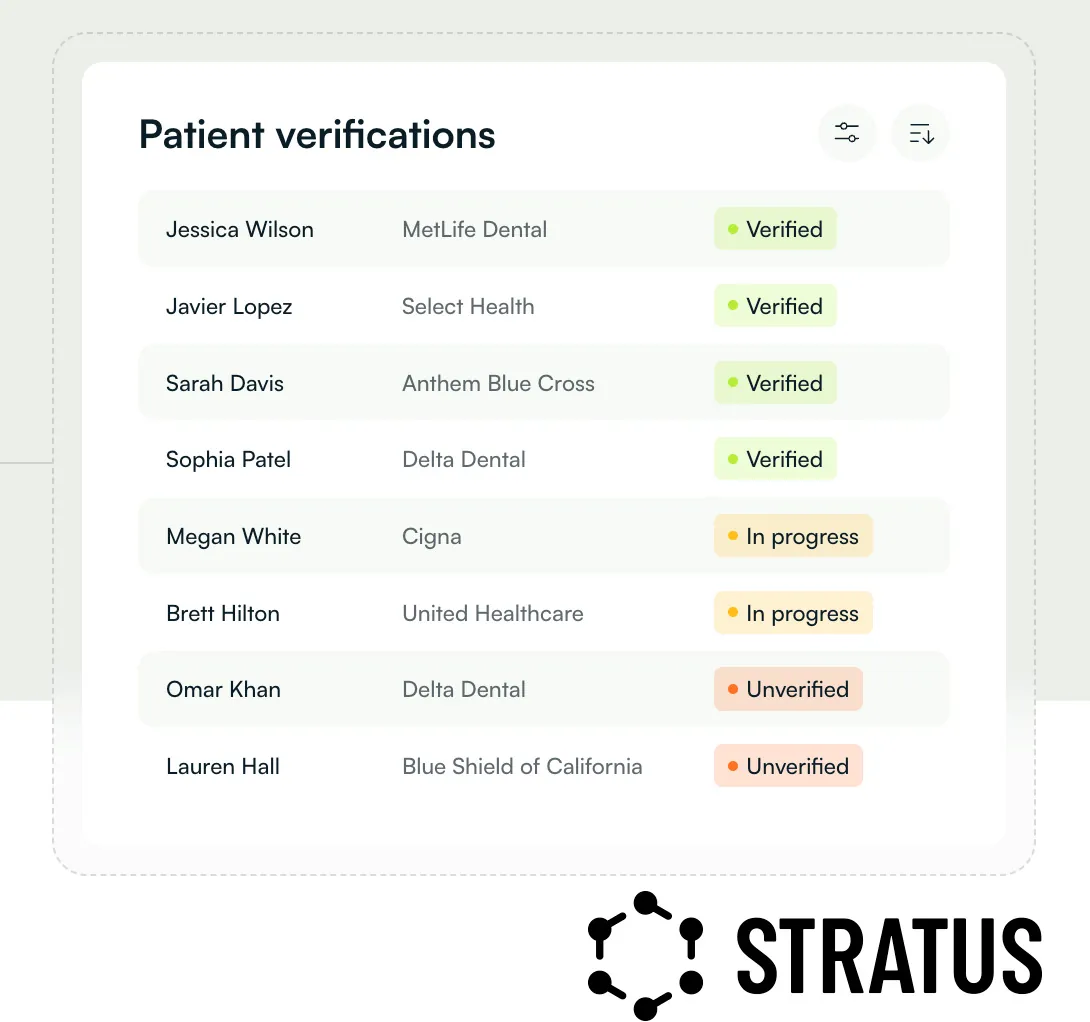

So Dr. Vohra, 35, recently began using Stratus, an AI solution that also seeks to automate insurance verification. It has helped her develop comprehensive treatment plans, with detailed breakdowns of insurance benefits, for patients.

Stratus automates insurance verification, freeing your staff to focus on patients. Reduce errors and improve efficiency seamlessly.

“It has made a night-and-day difference,” she says. “I think AI is going to completely take over the entire realm of dental insurance.”

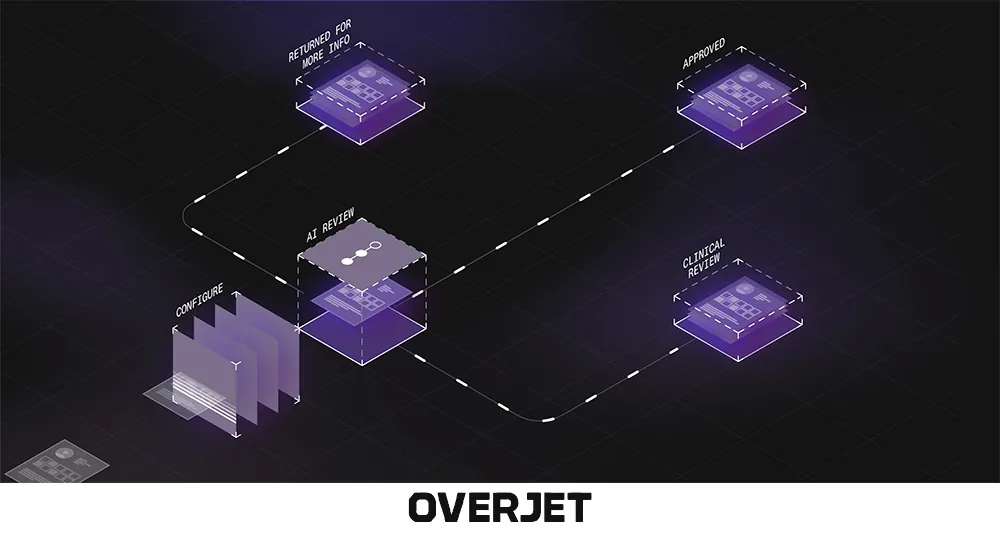

A key player in AI’s emergence into the dental insurance field is Overjet, a Boston-based firm perhaps best known for its AI platform that analyzes radiographs. It also offers an AI-powered dental insurance platform that helps insurance companies review claims for medical necessity. The system then automatically approves the claims—or sends them to human reviewers if more information is needed or rejection is possible. In those instances, the human reviewers make the final determination. “There is a misconception out there that AI is automatically rejecting claims,” says Logan Goldberg, Overjet’s communications director. “The reality is that it never automatically rejects.”

The future for A.I. in dental insurance looks bright.”

Overjet says AI simplifies insurance, improving consistency and efficiency. Since AI systems can analyze masses of data submitted by dental practices, such as radiographs and procedure codes, claims are decided much more quickly. “It’s exponentially faster,” Goldberg says.

Overjet AI automatically approves claims that meet plan criteria and routes the

remainder for clinical review or back to the provider for more info. AI is never used to automatically deny claims.

At least one major dental insurer, Delta Dental, is also an AI fan. In an April 2023 blog post on its website, the company declared that “the future for AI in dental insurance looks bright.”

Quoting Dr. Daniel Croley, Delta’s chief dental officer, the post said AI can analyze insurance data “far more quickly and accurately than a person can” and help “dramatically expand insurers’ ability to detect fraud.”

The post did not specify how Delta Dental uses AI, and company spokespeople declined to comment. “AI is an emerging and evolving technology, so its full promise hasn’t been realized,” the post concluded, “and there are still challenges that must be overcome.”